tax forgiveness pa chart

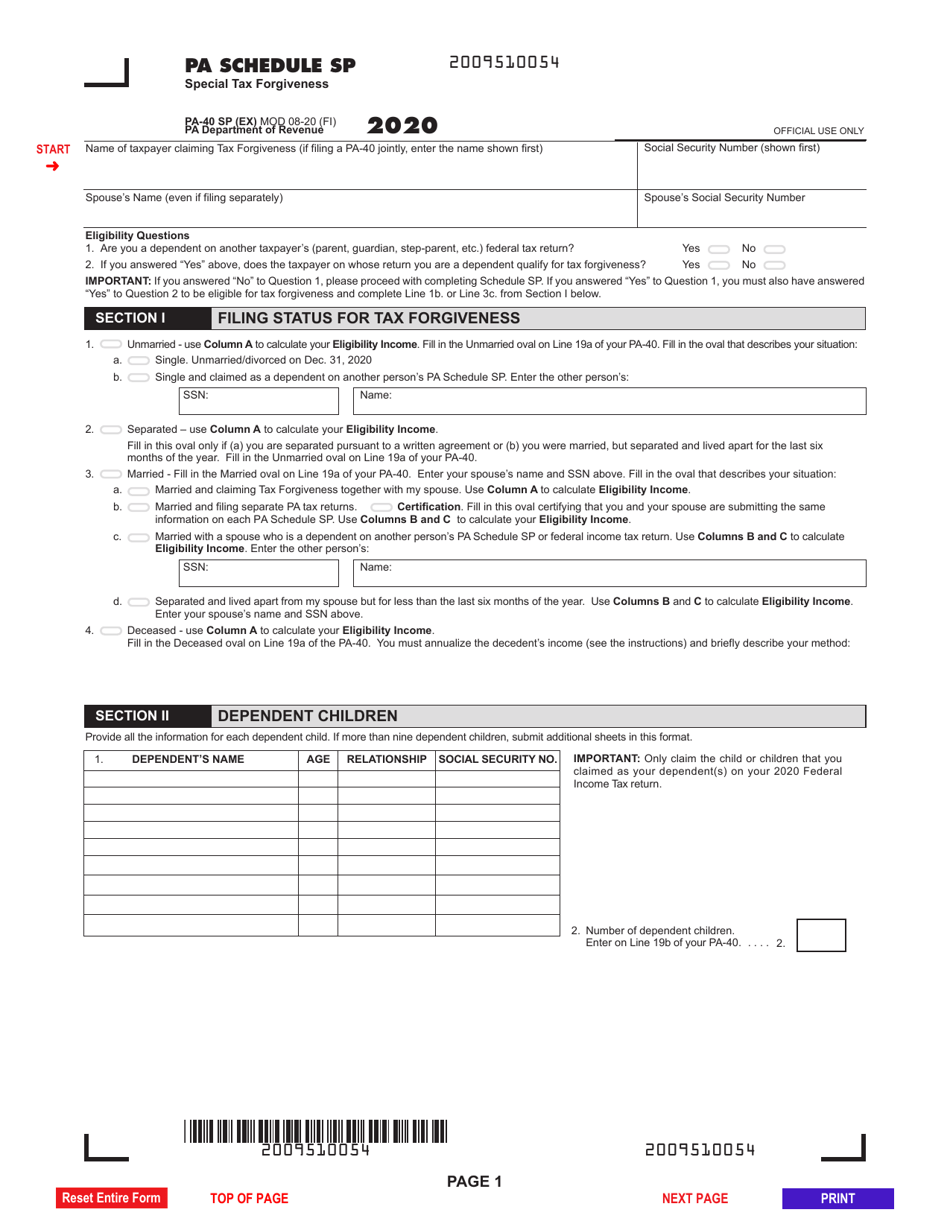

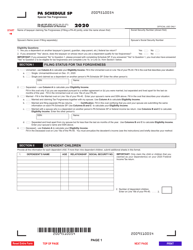

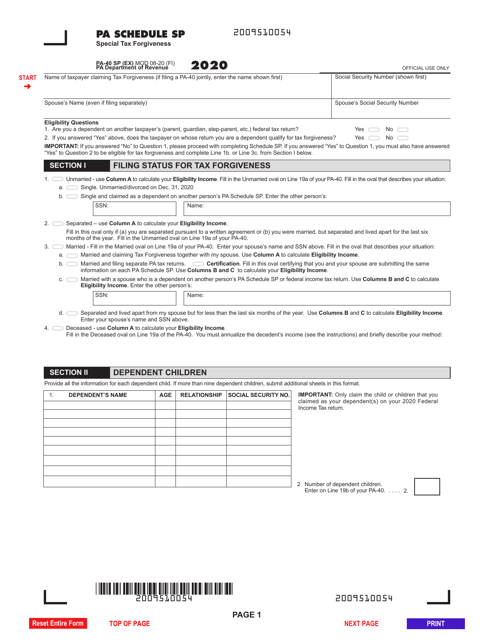

PA-40 Schedule SP must be completed. Enter on your PA-40 Line 21.

Pennsylvania Sales Tax Small Business Guide Truic

If you are filing as Married use Table 2.

. Was this answer helpful. 050 or more to the next highest dollar. 90 percent tax forgiveness if their eligibility income is more than 32000 but no greater than 32250.

Business Sales and Use Tax Business must register to collect and remit sales and use tax for 4 years. Want Zero Balance A Fresh Start. Move down the left-hand side of the table until you come to the.

The departments instructions allow dependent children to claim tax forgiveness because as the 1974 law identifies the intent of the General Assembly as described above. A dependent child with taxable income in. Married taxpayers filing jointly use Column Aand Eligibility.

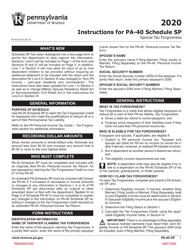

In Part D calculate the amount of your Tax Forgiveness. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their pennsylvania personal income tax liability. Tom Wolfs 2021-22 budget proposal includes the largest personal income tax rate increase in state history while also providing some tax forgiveness or relief to lower.

UNMARRIED means single widowed or divorced on December 31. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. For example 10 means you are entitled to 100 percent Tax Forgiveness and 20 means you are entitled to 20 percent Tax.

Ad Honest Fast Help - A BBB Rated. Form PA-40 SP requires. 100 Money Back Guarantee.

Tax forgiveness pa chart Saturday February 19 2022 Edit. Rated Number One For Businesses. Get the Tax Relief That you Deserve With ECG Tax Pros.

Create this form in 5 minutes. Use signNow to eSign and send out Pa sp tax forgiveness for eSigning. Want Zero Balance A Fresh Start.

What is Tax Forgiveness. Ad Suffering From Tax Problems. Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability.

And included with an originally filed. The amount of tax that is eligible to be forgiven depends on their filing status the income level for the year and the number of dependent children you have if any. Tax Forgiveness Pa Chart.

Provides a reduction in tax liability and. Rate answer 1 of 3 Rate answer 2 of. Get the Tax Relief That you Deserve With ECG Tax Pros.

Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. That same family of four with eligibility income more than 34000 but no greater. On the other hand if you dont file your.

21st Century Cures Act Medicare Advantage Risk Adjustment Payment Model. PA Schedule SP Eligibility Income Tables. Rated Number One For Businesses.

Consult With ECG Tax Pros. It is worth noting that during their 2021 legislative sessions multiple states have enacted legislation conforming to the current federal tax treatment of forgiven ppp. 100s of Top Rated Local Professionals Waiting to Help You Today.

Fill in the oval that describes your status as of December 31. PA-40 Personal Income Tax Return for any. Multiply Line 14 by the decimal on Line 15.

Be ready to get more. Ad Honest Fast Help - A BBB Rated. Tax penalties or interest for periods prior to September 1 2010.

Record the your PA tax liability from Line 12 of your PA-40. Small Business Administrations Paycheck Protection Program PPP is providing an important lifeline to help keep millions of small businesses open and their workers. Create this form in 5 minutes or less.

A reference chart on the state tax treatment of Paycheck Protection Program PPP loan forgiveness as taxable income as well as whether a state allows expenses paid. Separated pursuant to a written separation. Click the Tax Forgiveness Chart link to see teh PA Schedule SP Eligibility Income Tables.

If you are filing as Unmarried use Table 1. Ad Suffering From Tax Problems. Consult With ECG Tax Pros.

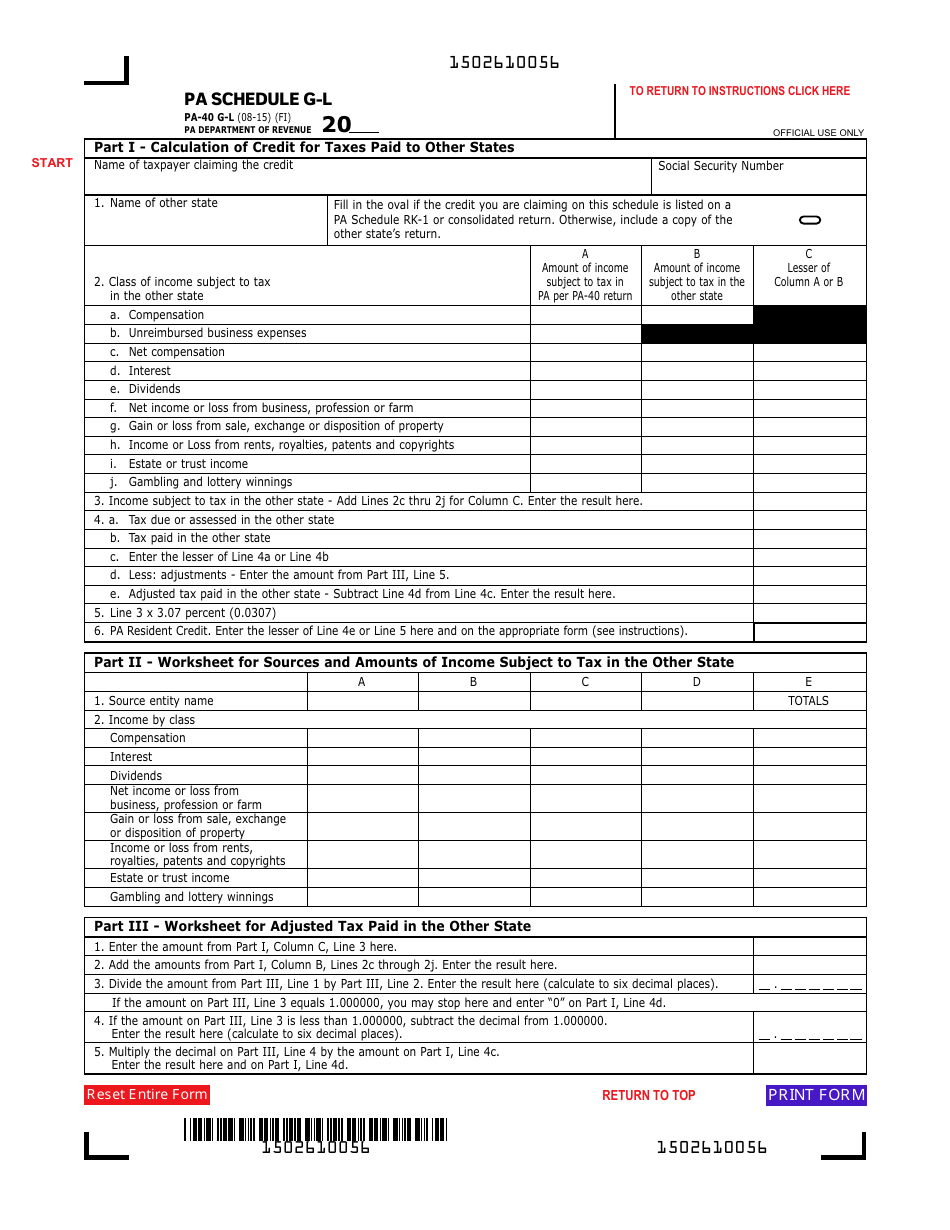

Record tax paid to other states or countries. 100 Money Back Guarantee. Represents the percentage of Tax Forgiveness you are allowed.

Form Pa 40 Schedule G L Download Fillable Pdf Or Fill Online Resident Credit For Taxes Paid Pennsylvania Templateroller

![]()

Commonwealth Of Pennsylvania V Navient Corporation Et Al Commonwealth Corporate Student Loans

This Chart Shows You Which Cases Allow For Student Loan Cancellation And Forgiveness Scholarships For College Student Loan Forgiveness Student Loans

Historical Pennsylvania Tax Policy Information Ballotpedia

Commonwealth Of Pennsylvania V Navient Corporation Et Al Commonwealth Corporate Student Loans

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

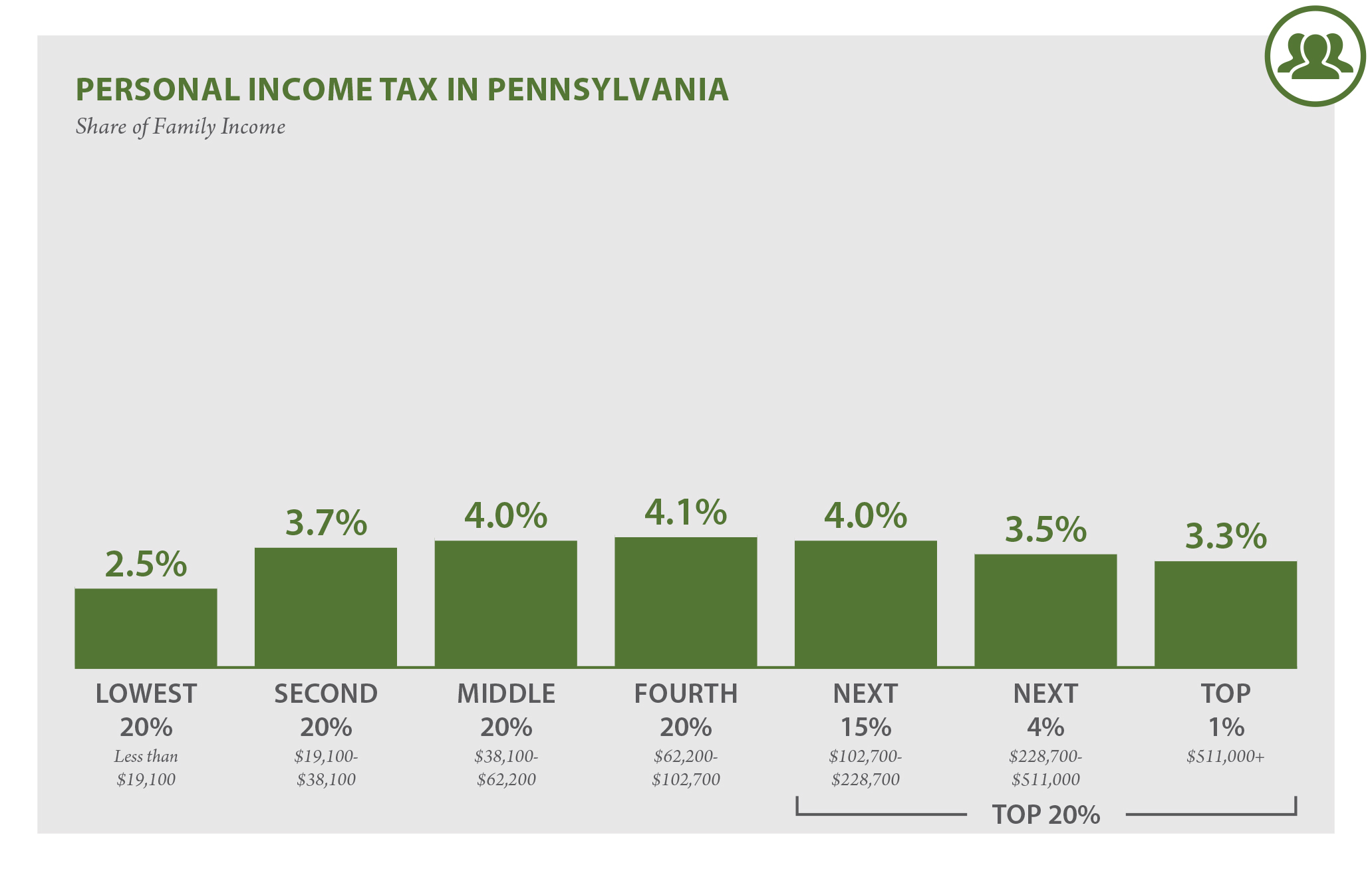

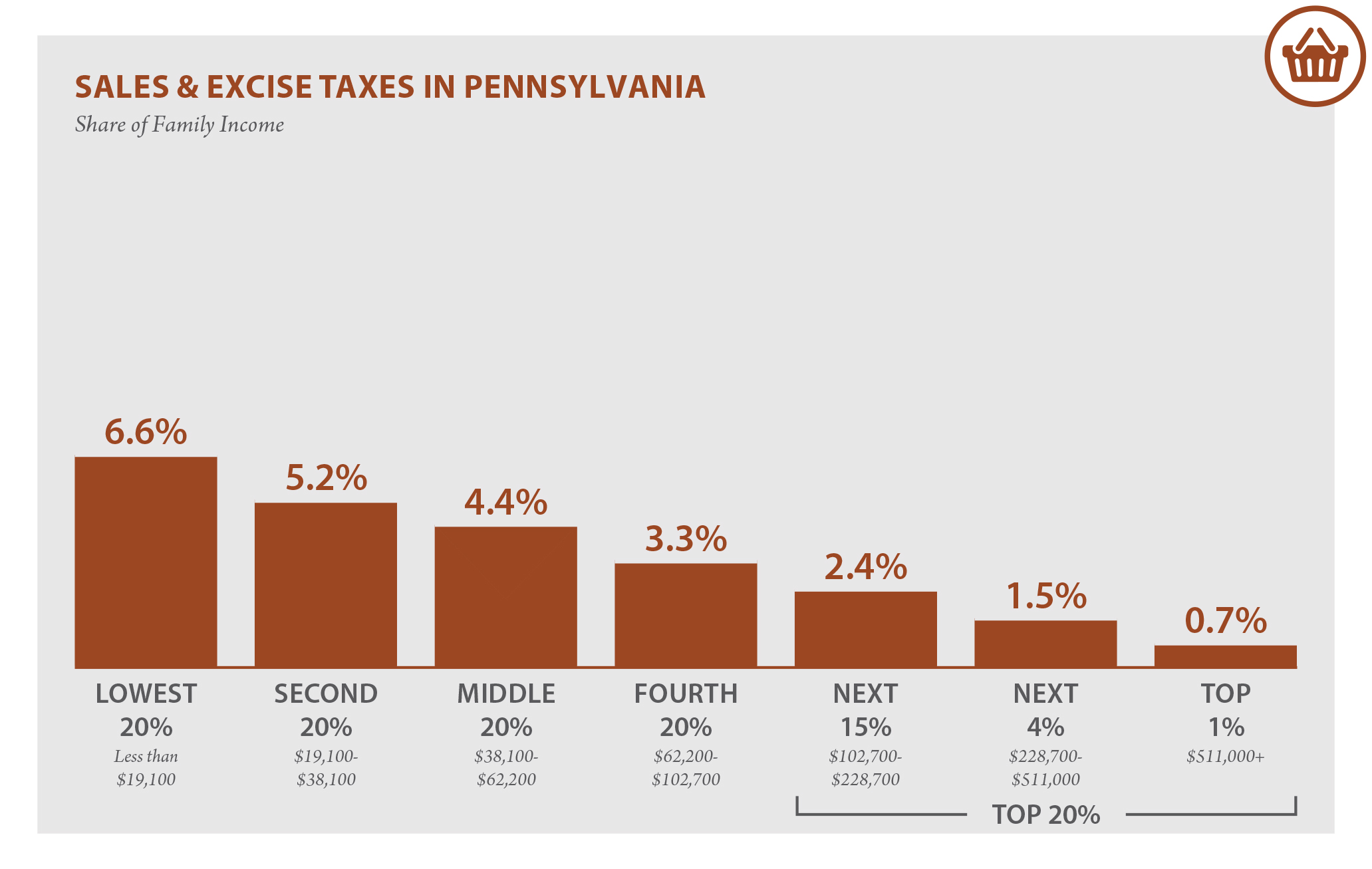

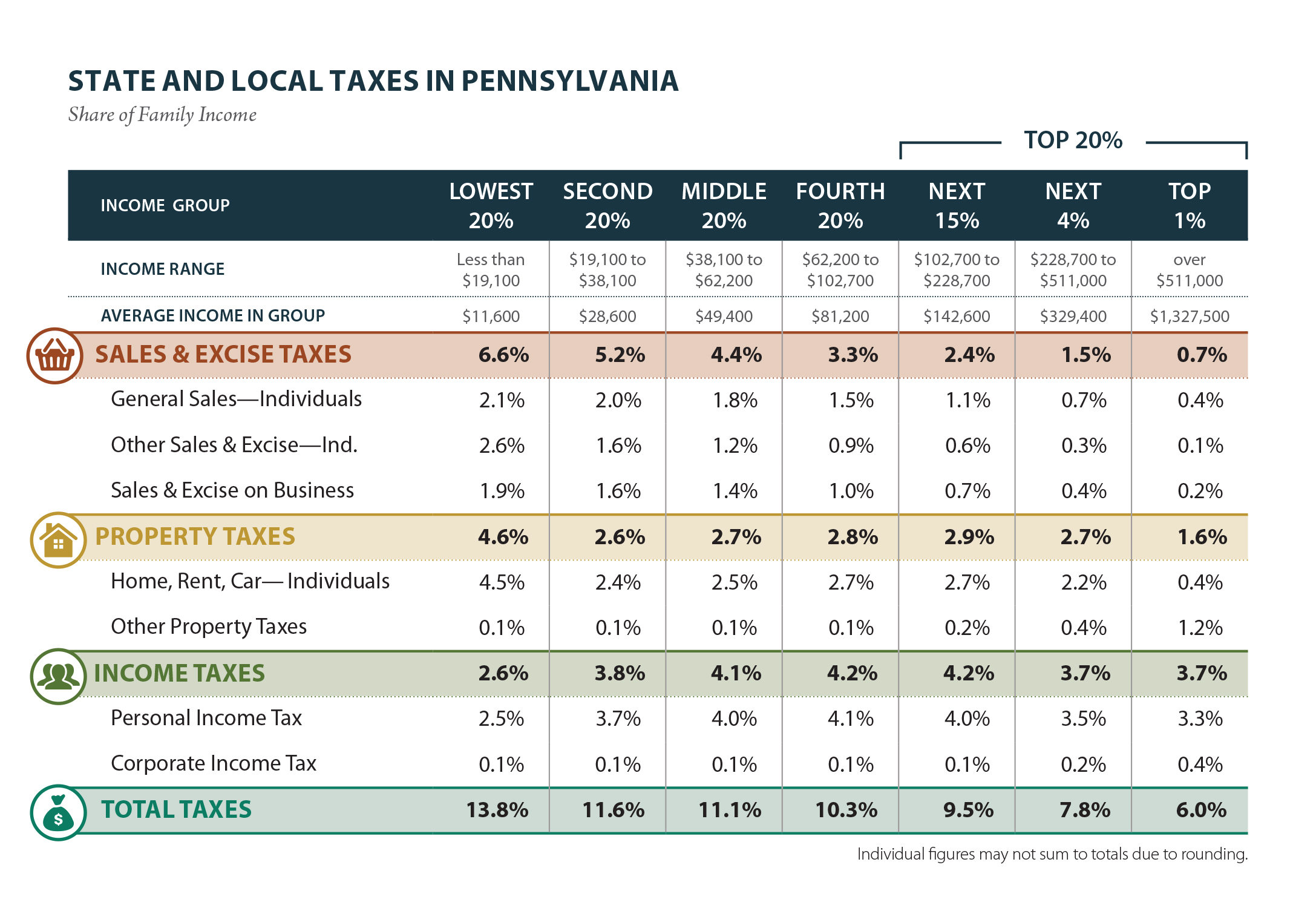

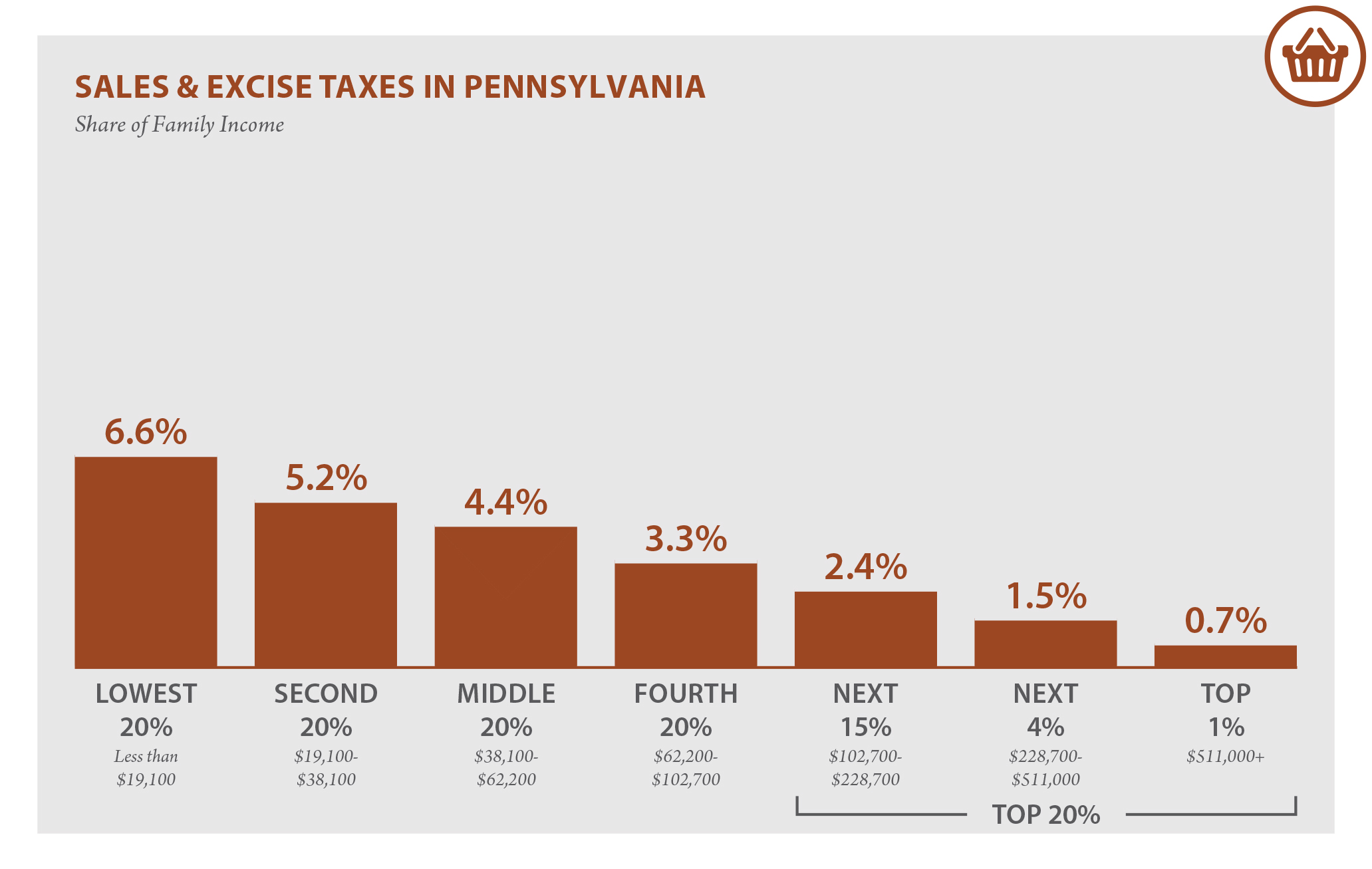

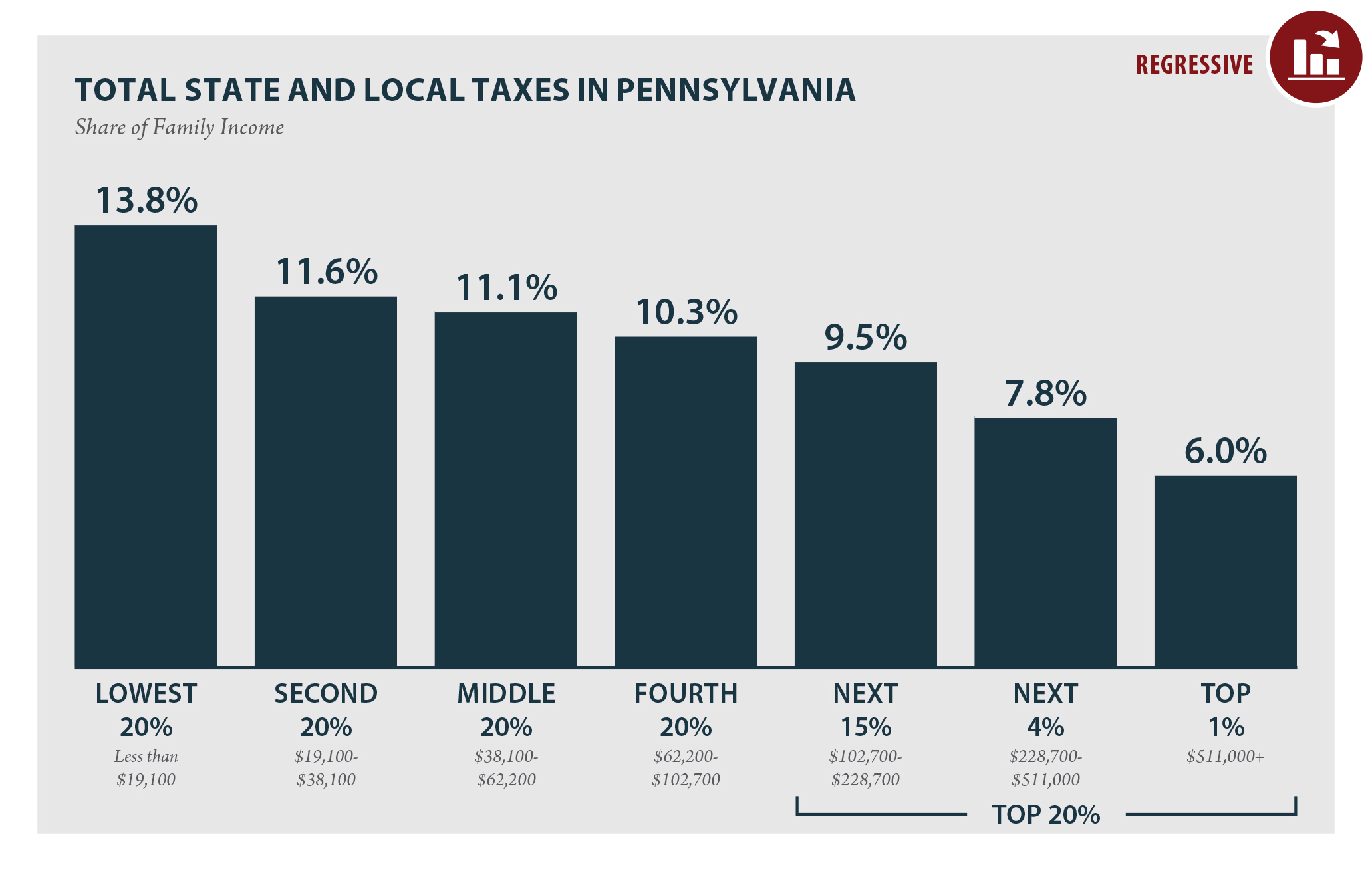

Pennsylvania Who Pays 6th Edition Itep

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

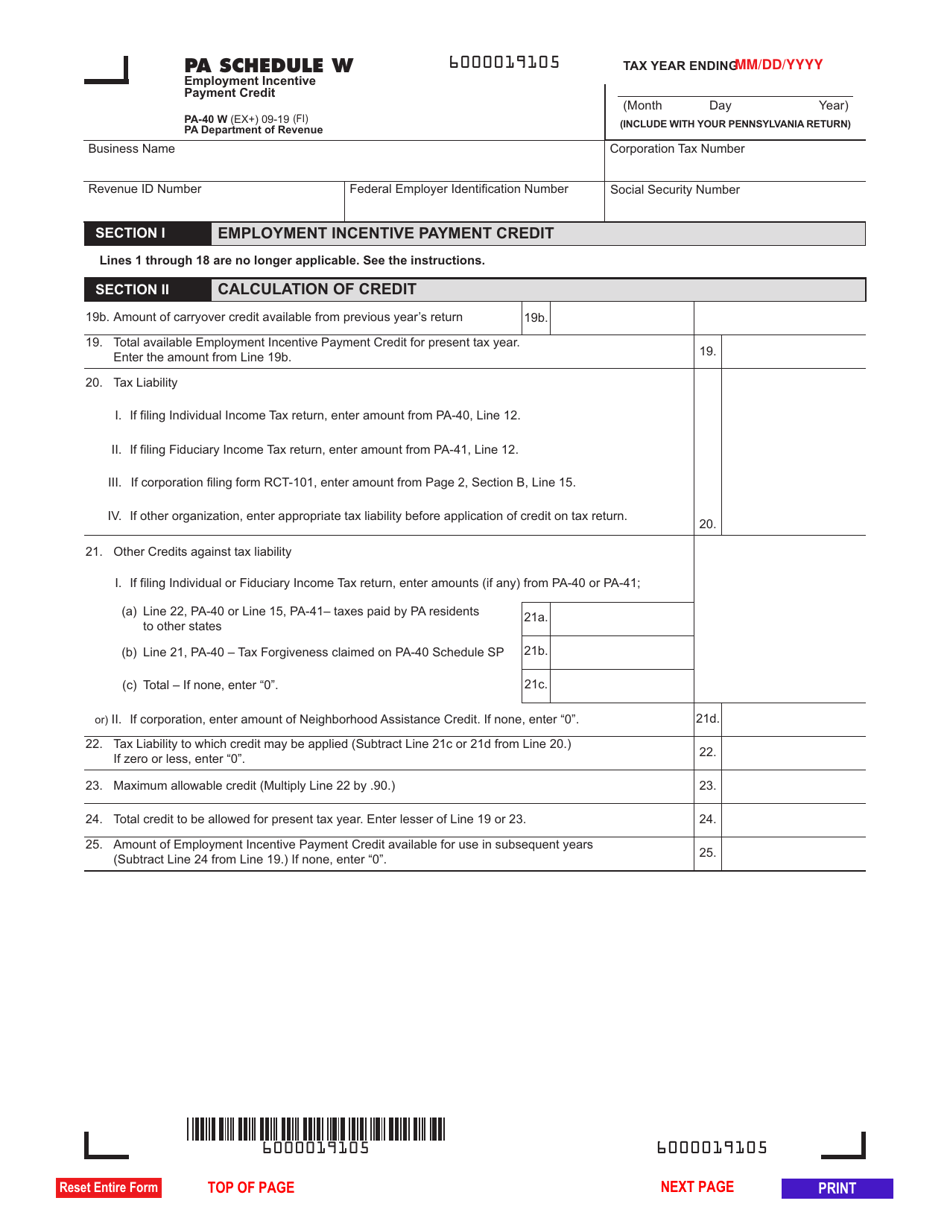

Form Pa 40 Schedule W Download Fillable Pdf Or Fill Online Employment Incentive Payment Credit Pennsylvania Templateroller

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pennsylvania Who Pays 6th Edition Itep

Pa Cares Providing Relief For Working People In A Time Of Crisis

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pennsylvania Who Pays 6th Edition Itep